Nicole Muhly, Servus Web and Digital Media Specialist, wants you to start saving before she did. Seriously, use that compound interest!

A typical laddering strategy is a great move for investing beginners due to its low risk and flexibility. But there's one major catch: you need to start with about $5000 (as most GIC investments have $1000 minimums). Which is a lot of money, especially if you've just started saving.

Enter the delayed laddering strategy. Same idea, same advantages (like access to your money every year and being able to take advantage of increasing rates or different investing strategies), but more accessible: you only need $1000 to start. Using compound interest to your maximum advantage means starting as soon as possible.

Getting to $1000

You could start with your tax refund or with the year-end bonus you got at work, or you can start saving for this more-achievable amount now with a PAC (pre-authorized contribution). You'll reach the $1000 goal in 40 weeks (about 10 months) if you commit to $25/week. To do it in a year is just under $84/month or $20/week. Set it up to take this amount automatically off your pay: you'll be less likely to spend it and your budget will adjust (you probably won't even notice it after a few months!). If you like to watch your progress in real-time, try our digital goal-setting tool.

TIP: Start small! Budget in weekly amounts, rather than monthly. If you're having a hard time adjusting to a new budget, a weekly budget is easier to correct and adjust little-by-little. You might give up on a monthly budget because it's less flexible, so work your way up to saving more.

Starting your ladder (Year 1)

Once you have your minimum ready to go (and keep in mind, some investment products do allow for lower minimums- talk to your financial advisor about this as an option!), you put that money into a 1 year GIC and you keep saving.

TIP: Tax-Free Savings Accounts (TFSAs) aren't just savings accounts! Put your money into TFSA GICs to take advantage of the tax-sheltered benefits of this registered account type. Learn more about TFSAs.

Build on the good habits you started to get your first "rung" and keep saving for the next year.

TIP: Double down! Increase your regular contributions and save a little more than you were the previous year. Adjust your savings to match any raises and cost-of-living increases you received. While the minimum to start might be $1000, aim higher! Any additional savings will benefit from the compound interest.

Add to your ladder (Years 2 to 5)

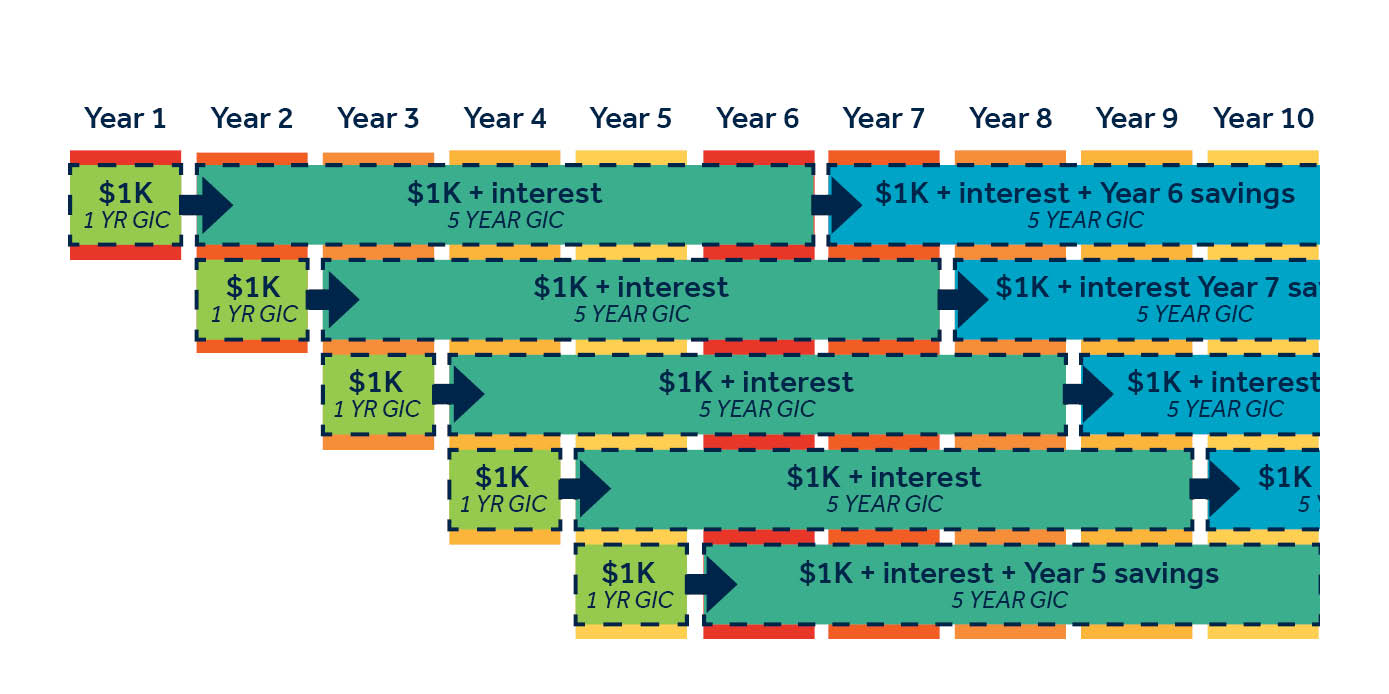

In year 2, you'll reinvest the first $1000 (plus the interest) into a 5 year GIC because it will have a better rate. The second $1000 you saved goes into another 1 year product and when that year is up, you reinvest in the 5 year.

And in years 3, 4, 5 you do the same thing. Each additional investment starts out in a 1 year GIC to take advantage of the flexibility of a maturing product (you never know when you might need the money) and in the second year is reinvested into a 5 year term to maximize interest rates.

Climb that ladder! (Year 6 and beyond)

By year 6, all of your 1 year GICs will have matured and you'll only ever renew for 5 year products now. Each 5 year GIC is now staggered by a year so you still have the flexibility of being able to access around 20% of your total funds each year.

The money you save in year 5 (and all the following years) can be added to the most recent investment that's ready to be renewed into a new 5 year product.

TIP: All of this is very easy to DIY using calendar reminders to track maturity dates and then purchasing new products through online banking. BUT paying attention to renewals can be an organizational nightmare if that's not your jam. Let a financial advisor do the work for you. If you schedule a yearly financial checkup (or even an annual email check-in) the month before your yearly investments mature, you can discuss the best products for your situation and get your advisor to do the heavy lifting of setting up the new products.